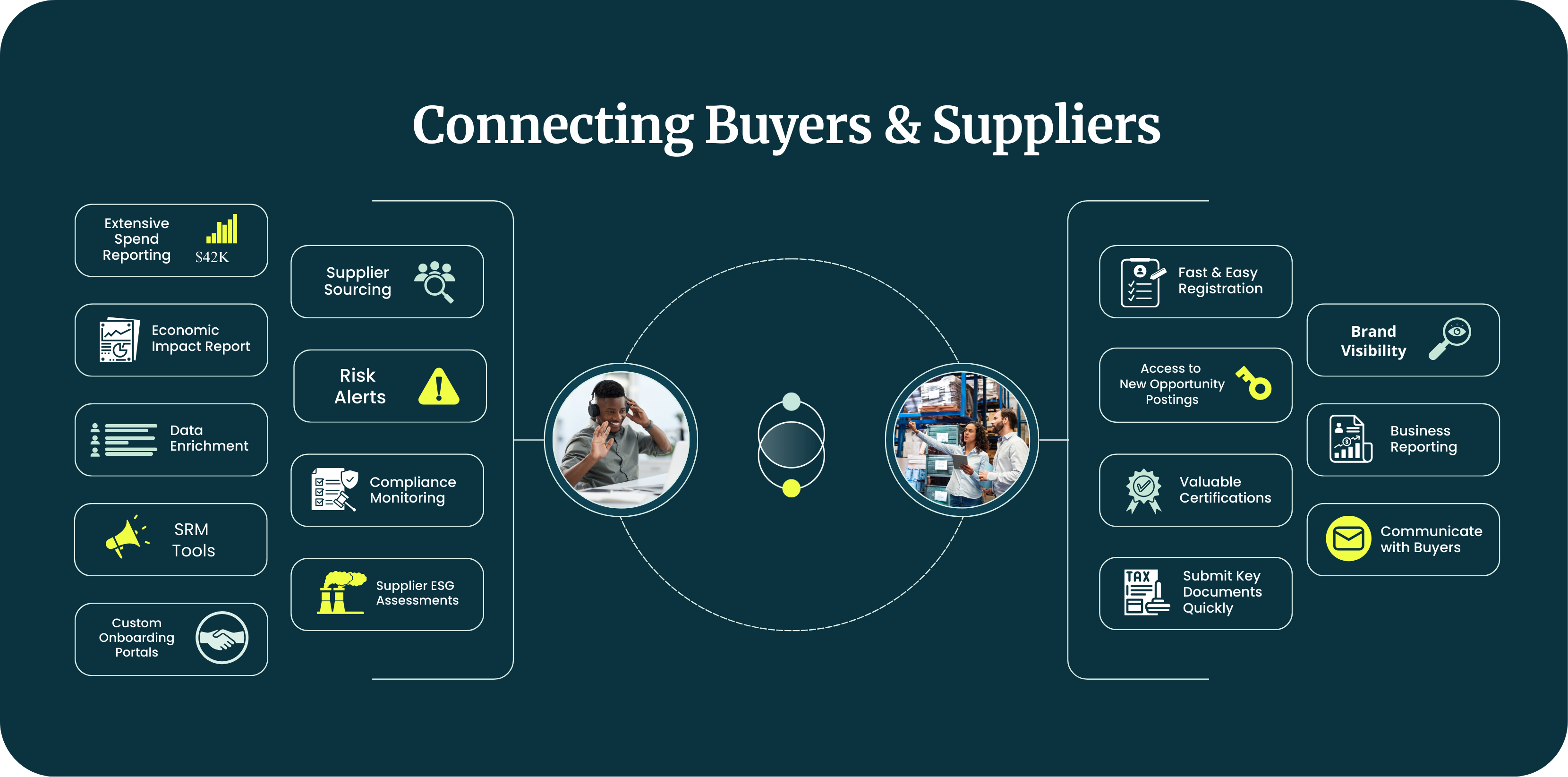

Buyers. Suppliers. Connected. Managed.

Manage All of Your Supplier Data in One Platform

Manage All of Your Supplier Data in One Place

End-to-End Procurement Solutions

|

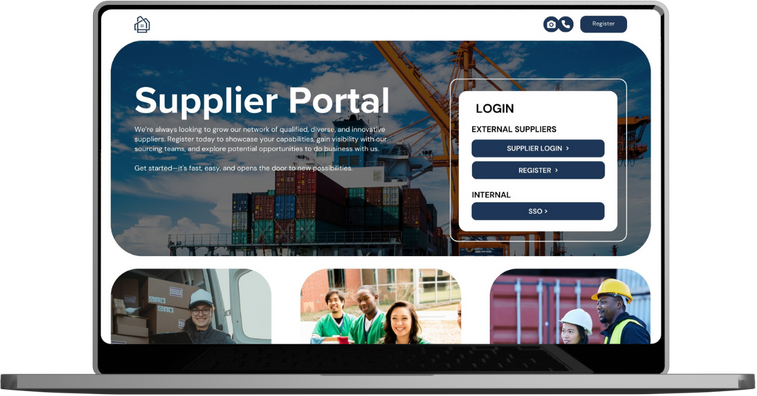

Ensure internal compliance and reduce risk in your supply chain. Onboard and offboard suppliers across your entire enterprise using a single portal and platform. Learn More > |

|

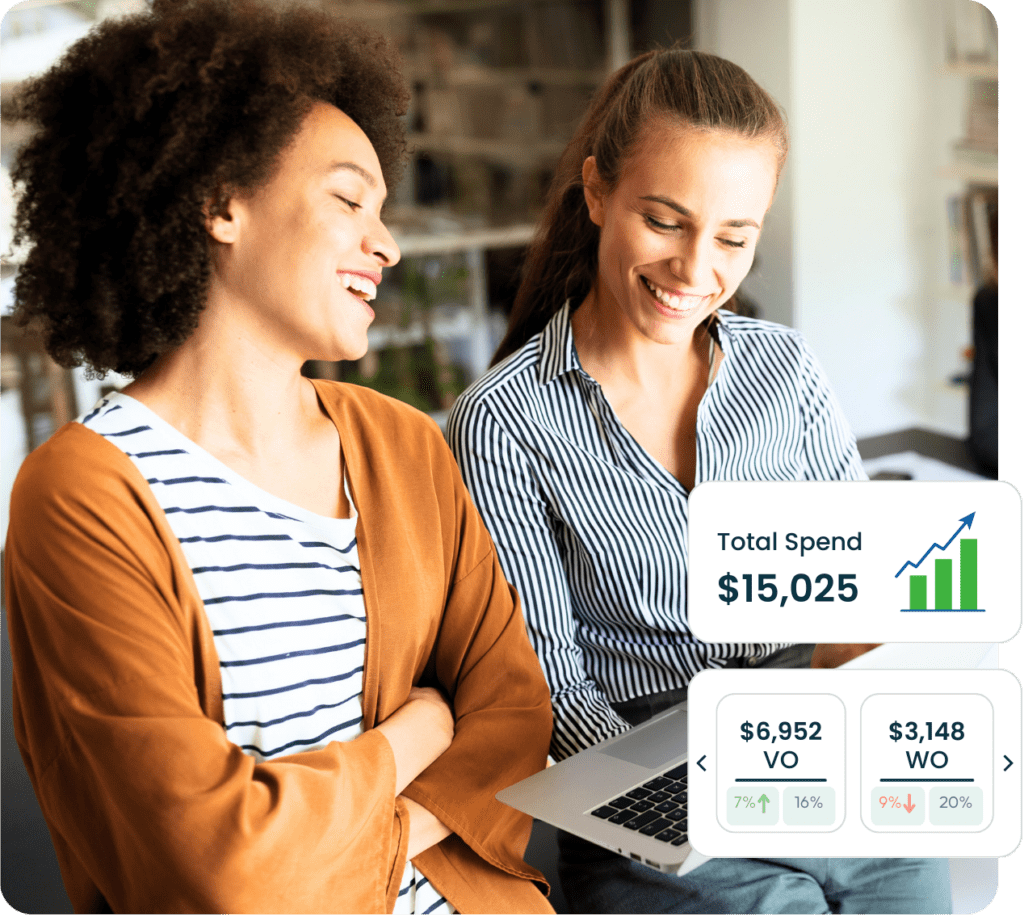

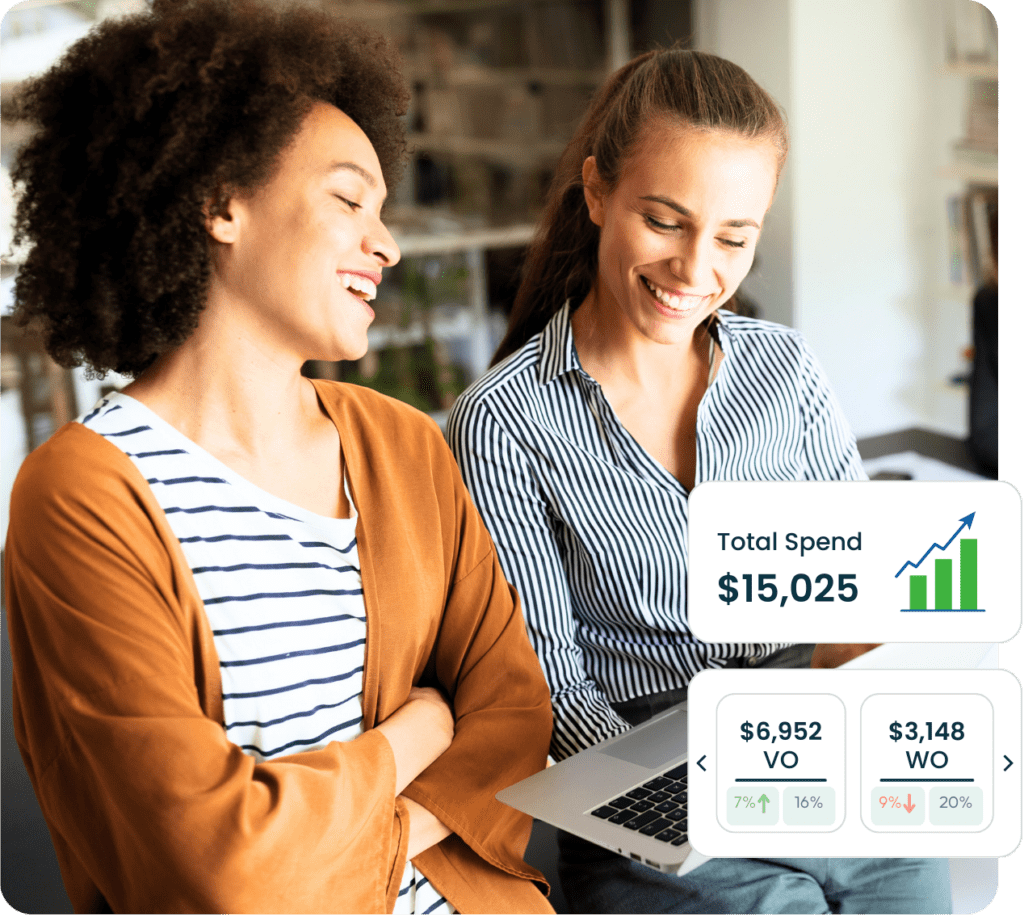

Grow and enrich your current inclusive supplier spend. Grow your program with powerful supplier sourcing and expand your reach with tier-2 and economic impact reporting. Learn More > |

|

Quickly assess your supply chain sustainability with ESG scoring. Create more transparency and leverage data to drive supplier compliance and performance. Learn More > |

End-to-End Procurement Solutions

|

Ensure internal compliance and reduce risk in your supply chain. Onboard and offboard suppliers across your entire enterprise using a single portal and platform. Learn More > |

Grow and enrich your current inclusive supplier spend. Grow your program with powerful supplier sourcing and expand your reach with tier-2 and economic impact reporting. Learn More >

Quickly assess your supply chain sustainability with ESG scoring. Create more transparency and leverage data to drive supplier compliance and performance. Learn More >

Get the Right Tools to Build a Resilient Supply Chain

- Enhance reliability with real-time risk monitoring, verified certifications, and data-driven insights

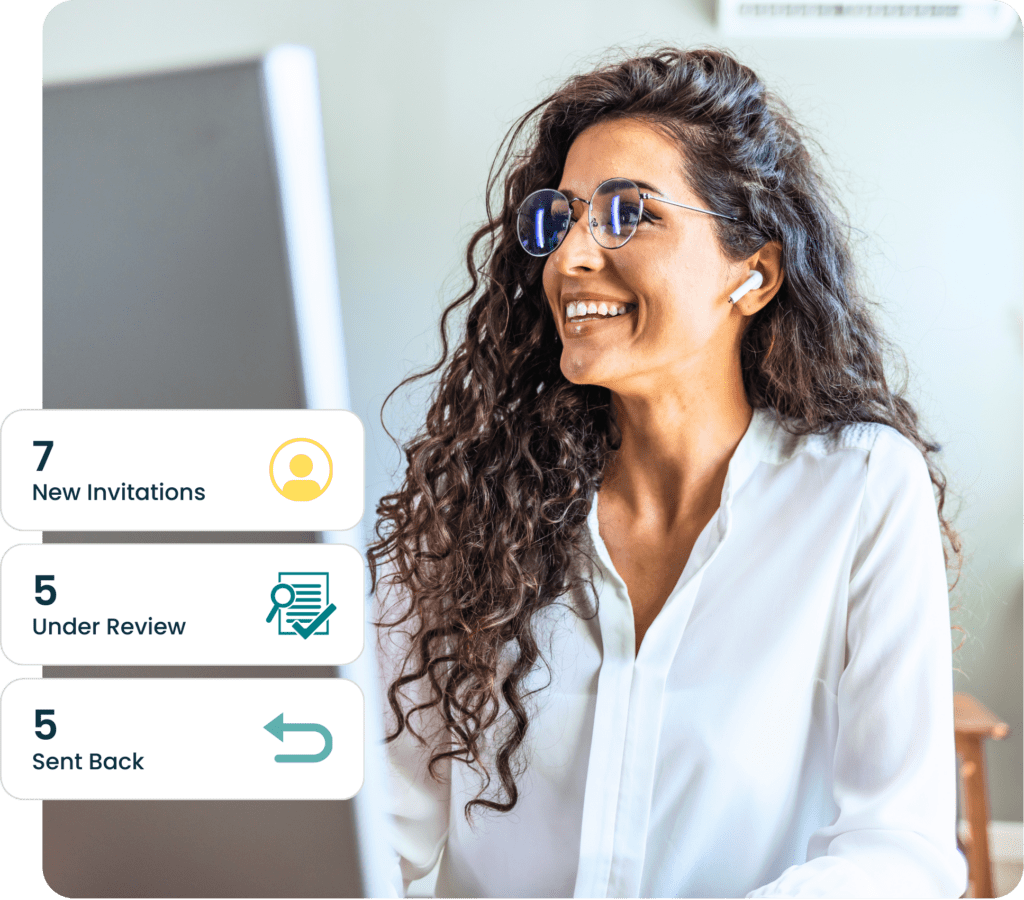

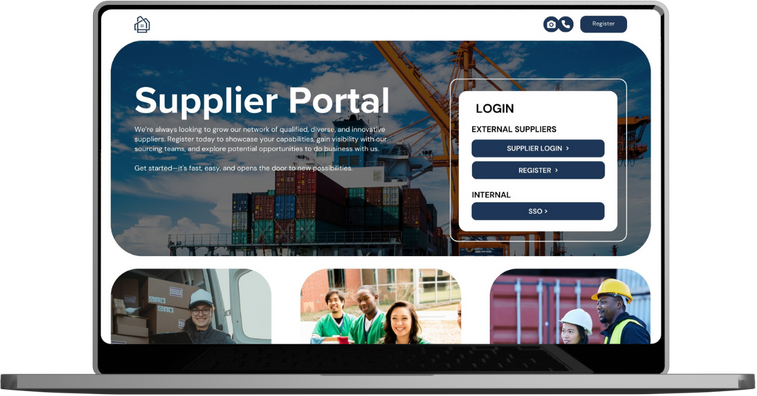

- Onboard and manage suppliers with customizable self-serve portals for registration, communication, contracts, and documentation

Get the Right Tools to Build a Resilient Supply Chain

- Enhance reliability with real-time risk monitoring, verified certifications, and data-driven insights.

- Onboard and manage suppliers with customizable self-service portals for registration, communication, contracts, and documentation.

NEW

Supplier Compliance Certifications

Verify your suppliers by sponsoring a block of digital compliance certifications or supplier verification checks to fortify your supply chain. Get the details on all the available verifications now!

NEW

Supplier Compliance Certifications

Verify your suppliers by sponsoring a block of digital compliance certifications or supplier verification checks to fortify your supply chain. Get the details on all the available verifications now!