Managing vendor risk in the financial services sector is critical to safeguarding sensitive data, ensuring regulatory compliance, and maintaining operational integrity. Manual vendor risk management processes can be time-consuming, inefficient, and prone to human error. Automating these processes streamlines operations and enhances the ability to manage risks effectively.

Here’s a framework tailored for financial services to automate vendor risk management, select the right solutions, and strengthen third-party relationships.

Why Automate Vendor Risk Management?

Financial institutions often deal with vast amounts of sensitive data and are subject to stringent regulations such as Dodd-Frank, Sarbanes-Oxley, and GDPR. Manual risk management processes can lead to:

- Lack of Visibility: Difficulty in tracking vendor compliance and performance.

- Limited Scalability: Challenges in managing a growing number of vendors.

- Compliance Risks: Increased risk of non-compliance with financial regulations.

- Monitoring Challenges: Inefficient monitoring of vendor activities and risk levels.

Automating vendor risk management addresses these challenges by reducing manual effort, improving accuracy, and providing a centralized source of information. This enables financial institutions to:

- Scale Operations: Efficiently handle large volumes of vendor data.

- Monitor in Real-Time: Continuously track vendor activities and compliance.

- Prioritize Risks: Focus resources on the most critical risks.

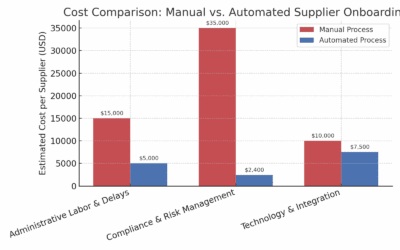

- Save Costs: Reduce labor costs and minimize errors and remediation expenses.

- Mitigate Risks: Protect sensitive data and systems with robust security controls.

Critical Steps to Automate Vendor Risk Management

- Assess Needs and Current Processes: Conduct a thorough analysis of existing vendor management processes, including vendor onboarding, risk assessments, and monitoring. This will help your organization identify inefficiencies, redundancies, and areas for improvement.

- Engage Stakeholders: Involve key stakeholders from compliance, IT, and procurement departments to gather insights and requirements. This ensures the automation solution your company selects aligns with organizational goals and regulatory requirements.

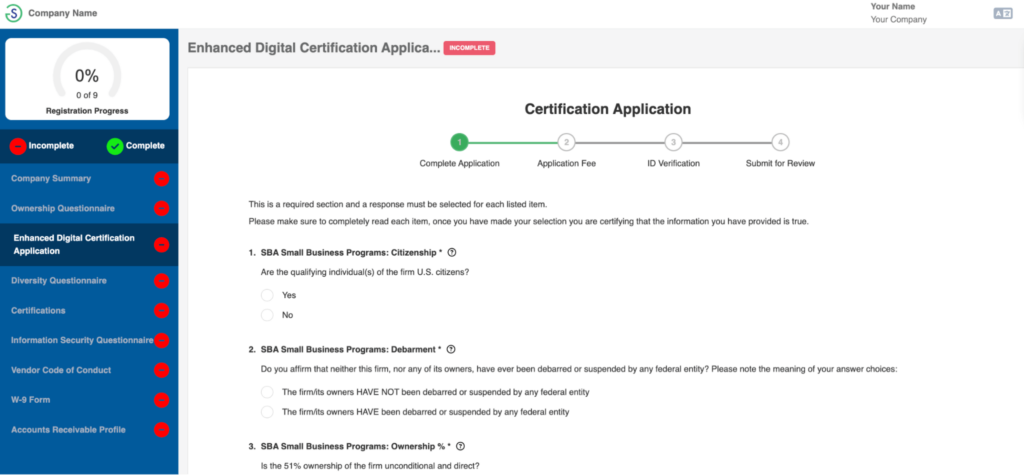

- Select a Vendor Risk Management Software: Choose a platform that offers ease of use, customization, integration capabilities, and strong support. SupplierGateway provides a user-friendly interface, seamless integration with existing systems, and comprehensive support.

- Implement and Integrate: Form a cross-departmental team that oversees the implementation process, defines project objectives, and creates a detailed action plan. Creating a cross-departmental team helps ensure a smooth transition via revising business processes and fostering cross-departmental collaboration.

- Ongoing Monitoring and Optimization: Track and report on your organization’s metrics, solicit feedback from different departments and suppliers and refine any automation processes to adapt to ever-changing regulatory requirements and business needs. Goal-tracking, ongoing feedback, and process refinement help your vendor risk management systems remain effective and aligned with your organization’s goals.

Simplify Vendor Risk Management with SupplierGateway

SupplierGateway offers a comprehensive, automated platform designed to meet the unique needs of the financial services sector. By leveraging SupplierGateway’s solutions, financial institutions can streamline vendor risk management processes, enhance compliance, and protect sensitive data, ensuring they remain competitive and secure in a rapidly evolving regulatory environment.